Community Profile

Community Profile

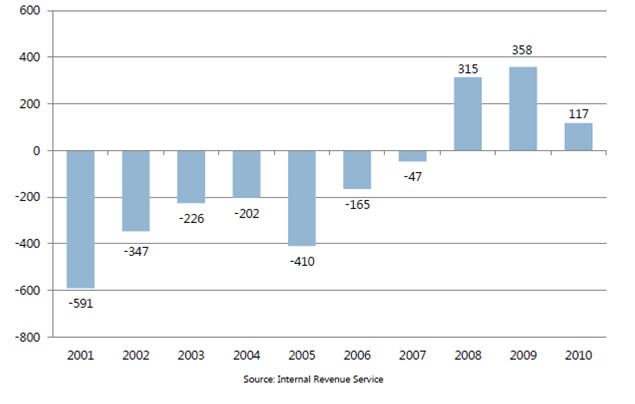

Grand Island is fortunate to have experienced a robust population growth within the last 10 years and weathered the recession better than many communities in the nation. Having exceeded a population of 50,000, Grand Island's growth upgraded its status to a metropolitan statistical area (MSA), joining the ranks of fellow Nebraska MSAs, Omaha and Lincoln.

Population

Grand Island has a population of 53,131 and a labor market population of 43,000.

Hall County added nearly 4,400 jobs between 2003 and 2013, with employment actually expanding by 3.6% between 2008 and 2013, a five-year period that corresponds with the national recession and subsequent recovery.

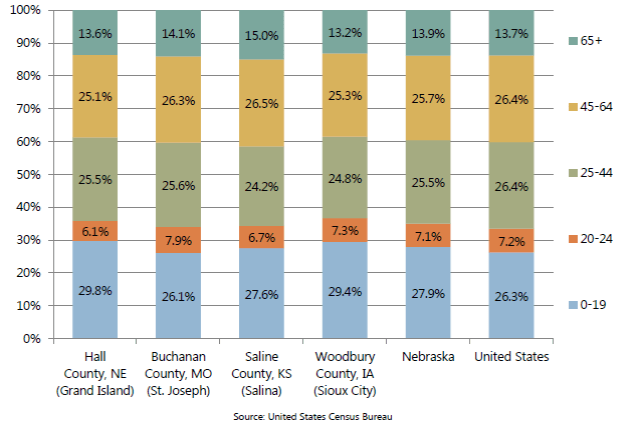

Age

The median age in Grand Island is 34.7 years, compared to the national median of 37.5 years.

The "19 and under" age group experienced the largest increase in population in the last decade, and is expected to continue to grow at a rate of 5.2%. This means Grand Island is full of young people ready to enter the workforce.

Race / Ethnicity

As the population in Hall County has grown, so too has its diversity. Ethnic minorities currently makeup 29.3% of the population in Hall County.

Income

According to the 2020 U.S. Census Bureau, Grand Island's median household income is $57,104. This is an approximate increase of $12,000 of household income since the 2010 Census.

Taxes

State Taxes

Sales and Use Tax - 5.5%

Individual Income Tax - Top rate of 4.1% on $50,000

Corporation Income Tax - Corporations pay 5.8% on <$100,000 and 7.81% on >$100,000

Corporate Occupation Tax - Varies according to the amount of authorized capital stock

Local Taxes

City Sales Tax - 1.50%

Property Tax is calculated on:

- Earning capacity of the property

- Relative location

- Desirability and functional use

- Reproduction cost less depreciation

- Comparison with other properties of recognized value

- Market Value in the ordinary course of trade (greatest emphasis is placed on this factor)

- Zoning

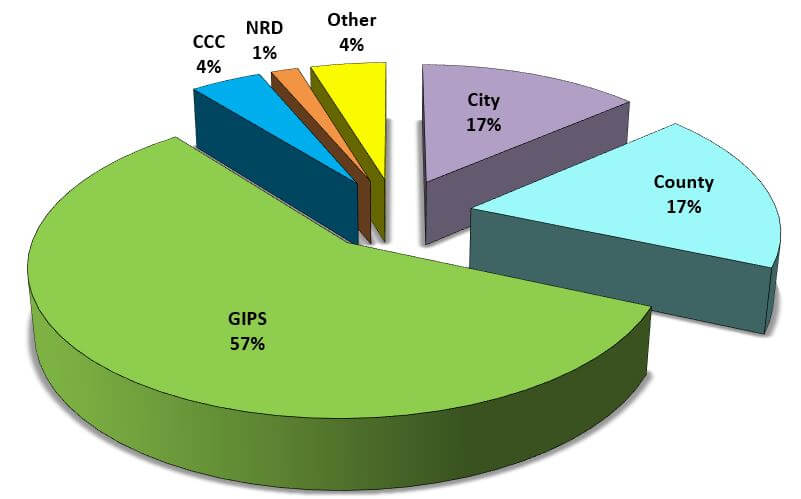

Grand Island and Hall County are committed to providing the best services at the least cost to their citizens.

Source: Hall County Assessor

Property Taxes

Tax Structure

- Actual Valuation of City $3,626,392,825

- 2020 Tax Rate ($ per $100 of actual value)

- City: 0.375504

- County: 0.390562

- School: 1.275490

- Other: 0.192213

- Total 2.233769

Source: Hall County Assessor

The City provides quality services to over 50,000 citizens in a 28 square mile area, 24 hours a day, 365 days a year. Property tax dollars help offset the cost of these services.

A levy indicates the amount of tax property owners pays for each $100 valuation of their property. Property Tax can be calculated by Assessed Valuation divided by 100 multiplied by the levy.

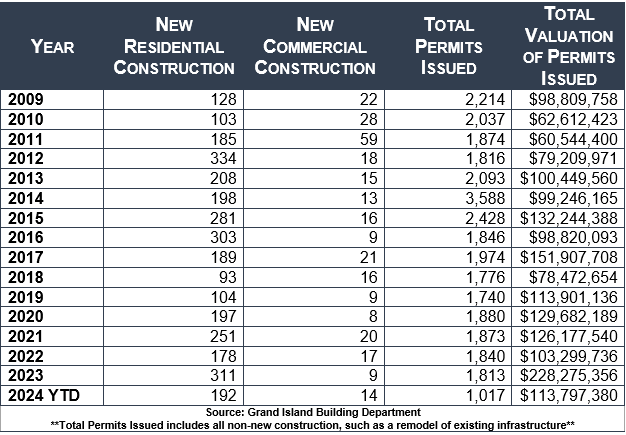

Building Permits

The economic growth and prosperity of a community can also be measured by development and renovations in residential housing and commercial properties. These numbers demonstrate that Grand Island residents are building, expanding, remodeling, and improving the community. Major projects include the development the Nebraska State Fair campus for $21,618,838; Grand Island Public School's renovation for $4,248,000; Good Samaritan Assisted Living for $2,383,000; Nova Tech, Inc. renovation for $4,800,000; Fairfield Inn & Suites, Holiday Inn, and Best Western for a combined total of $10,721,000; Hope Harbor Homeless Shelter for $850,000; Central Nebraska Regional Hospital and Medical Office Building.